How to Integrate Morpho Into Your Crypto Wallet (Without Rebuilding Your App)

Learn how to integrate Morpho into your crypto wallet, support Morpho Blue, Morpho Vaults, and Optimizers, and ship faster without rebuilding your infrastructure.

Written by

Uddalak

When users compare yields across protocols, Morpho often beats Aave by 20 to 40% on the same assets, depending on utilization, market structure, and the specific vault configuration.

Here’s how to add Morpho (and 200+ lending markets) to your wallet in under 7 days, without rebuilding your app.

Morpho improves lending rates through two different designs, depending on the product.

Why Integrate Morpho Now

Four reasons Morpho matters for wallets:

Rate-conscious users expect it. DeFi natives check Morpho early when they allocate capital. If your wallet only shows Aave, they will move funds elsewhere to optimize.

TVL proves demand. Morpho has ~$6B+ locked at the time of writing. Users already trust it with serious capital.

“Highest APY” needs to be real. Many wallets market yield. Fewer wallets compare across protocols and show the best net rate.

Large capital cares most. A user with $5K might ignore a 1% difference. A user with $100K+ won’t. Morpho consistently attracts that segment.

Which Users Need Morpho

Morpho is not for everyone. But it matters for the users who drive wallet TVL and long-term retention.

Usually, there are three types of users that consistently care:

Yield optimizers: They compare Aave, Morpho, and Compound before deploying capital. They want options, not a forced default.

DeFi power users: They already know Morpho’s reputation and have used it directly. If your wallet does not support it, your product reads as “not built for DeFi”.

Large allocators: Users with $50K+ in lending positions optimize carefully. At that scale, a 1 to 2% APY difference becomes hundreds or thousands of dollars per year.

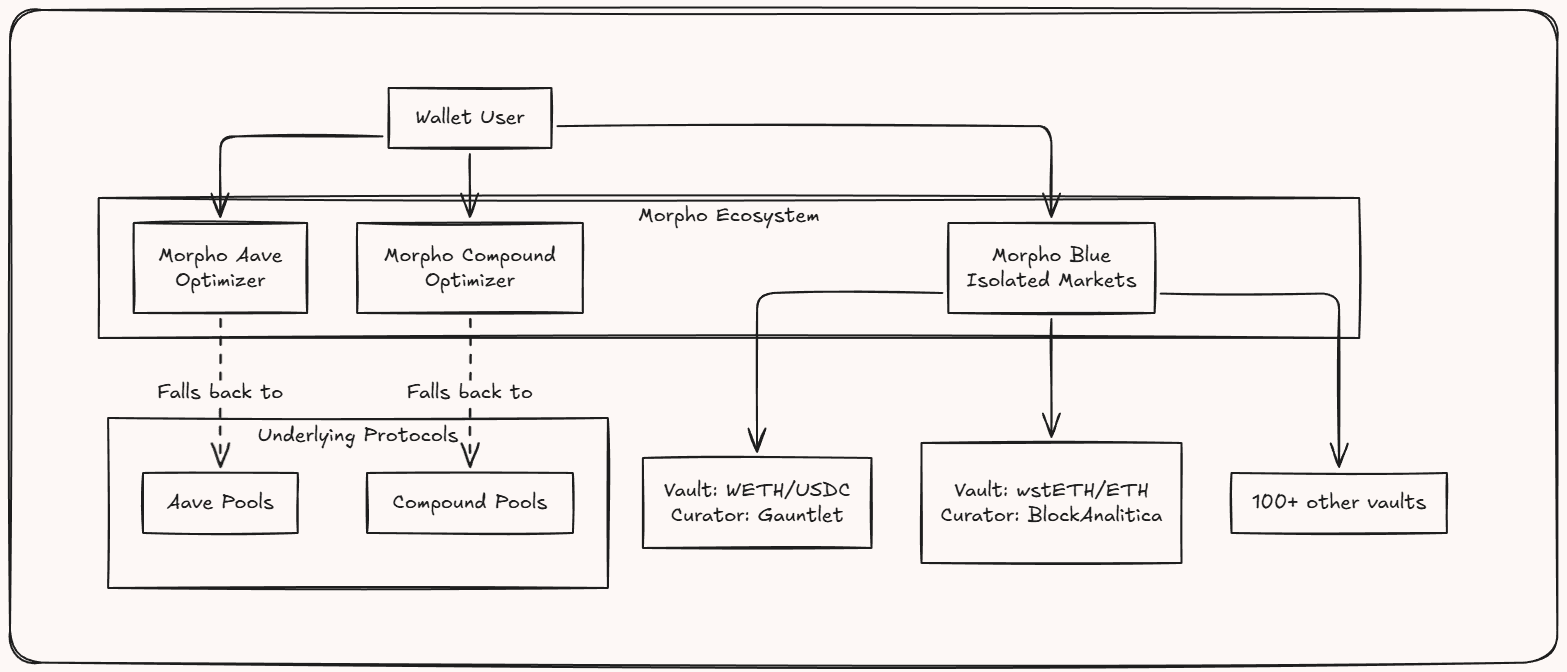

Understanding Morpho’s Architecture and Why It Delivers Higher Yields

Morpho Blue + Vaults: It is permissionless and allows anyone to create markets. Rates depend on each market’s utilization, interest rate model, and collateral configuration.

In practice, USDC on Morpho can earn ~8% while the same USDC earns ~3.4% on Aave.

That ~4.6% spread is meaningful at scale. On $50K of USDC, it is roughly $2,300 per year. On $500K, it is roughly $23,000 per year.

Morpho Optimizers (Aave + Compound): Optimizers attempt to match lenders and borrowers peer-to-peer first, then fall back to the underlying pool. Users avoid part of the pool spread, which increases lender yield and reduces borrower cost.

Why this means for wallet integration

For wallets, this means you’re not integrating “Morpho”. You are integrating Morpho Blue markets, Morpho Vaults, and Morpho Optimizers.

Each of these has different market discovery, risk parameters and evaluation, APY calculation, oracle design, and position tracking. It varies by vault, curator, collateral, and market configuration.

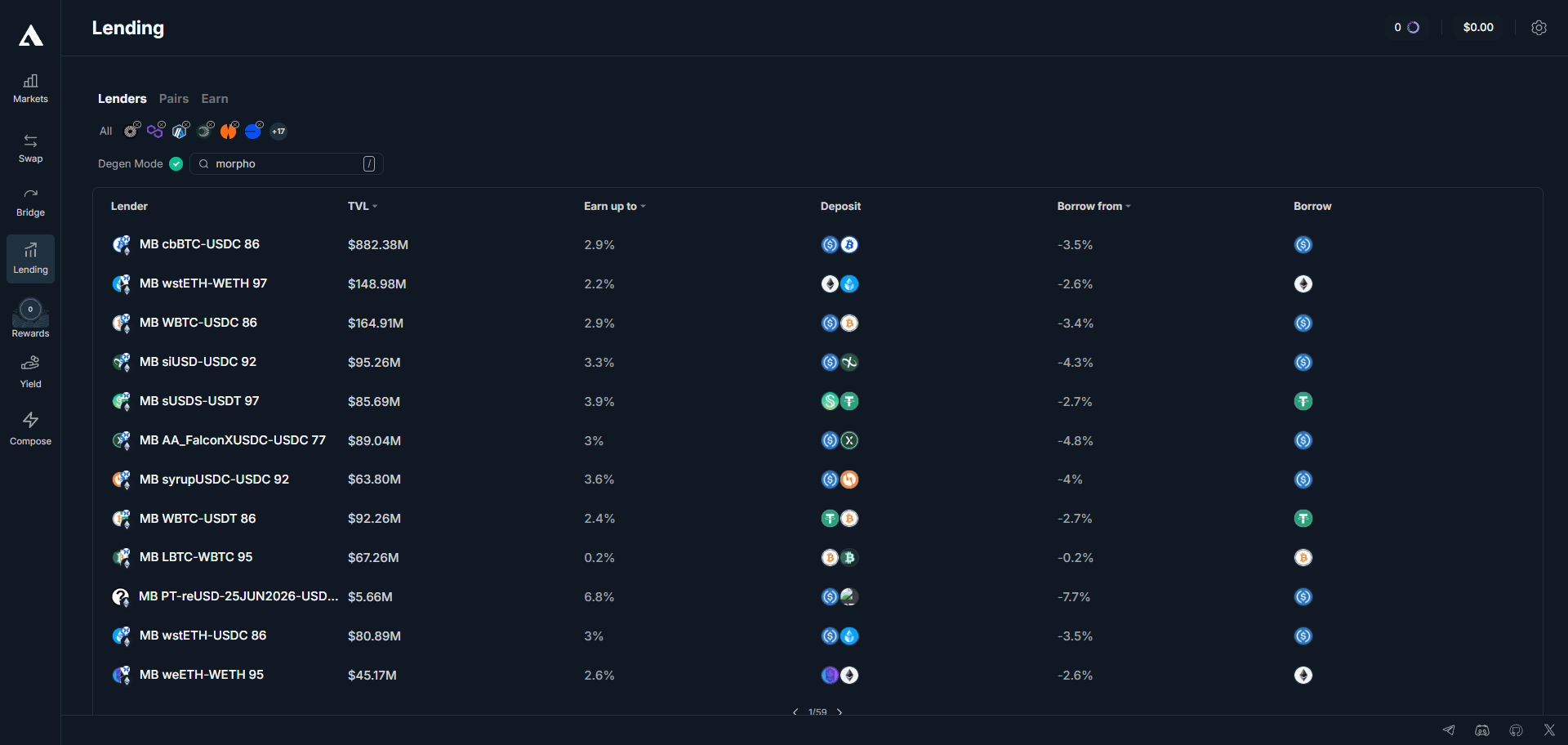

Choosing Which Morpho Products to Support

You do not need to support every Morpho vault on day one.

A better strategy is to ship the highest-confidence surface area first, then expand based on real usage.

Start with high-TVL Morpho Vaults and Morpho Blue markets on Ethereum and Base. These are the most battle-tested, with established curators and deep liquidity.

Add Morpho Optimizers for users who want Aave or Compound exposure with improved rates. The value prop is simple: the same underlying pool, but better execution.

Expand based on user behavior. If users hold specific assets, support those vaults. If your users are rate-sensitive, show more options. If they prefer simplicity, filter to top-tier vaults only.

The API gives you flexibility without forcing you to show everything. You define the curation strategy, and we execute it.

Integrate Morpho to Your Wallet Today

Morpho is not a “single protocol” integration.

You’re taking on vault discovery, curator filtering, vault-level risk assessment, unified position tracking across Morpho Blue, Morpho Vaults, and the Optimizers, and more.

Integration with 1delta takes about one week for a basic production integration that gives you access to everything with built-in vault filtering, risk scoring, position monitoring, and execution.

Request API access at 1delta.io or view technical documentation at docs.1delta.io.

Contact: Telegram | team@1delta.io