How to Integrate Compound Into Your Crypto Wallet

Learn how wallet teams integrate Compound v3, handle market-based positions and liquidation risk, using 1delta API.

Written by

Uddalak

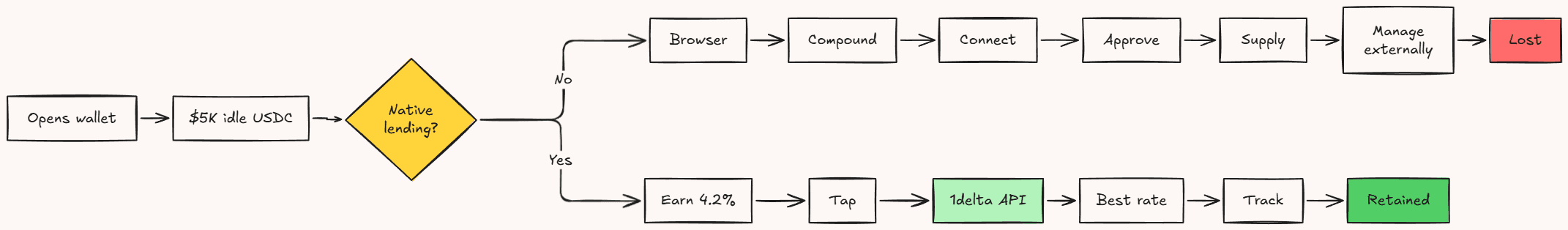

When users want lending and borrowing inside a wallet, they care about net rates, liquidity, and whether the position view is correct.

Compound is still part of the minimum set but it often clears at different rates than Aave and Morpho on the same assets.

This guide explains how wallet teams integrate Compound v3 and how to expand to 200+ lending markets across 50+ chains using a single API.

TLDR

Integrate Compound v3 lending and borrowing without building protocol-specific infrastructure

One API unlocks Compound plus Aave, Morpho, and 200+ lending markets

50+ chains, standardized positions, and execution guardrails

Typical integration: 3 to 7 days

Why Compound Still Matters for Wallets

Compound is one of the oldest and most trusted lending protocols in DeFi.

For many users, it is still the default “conservative” venue.

But the strategic reason wallets still need it is simpler: Compound often has different liquidity conditions than Aave and Morpho.

On some assets and chains, Compound can offer:

Better borrow rates because liquidity is deeper in that market

More stable supply rates under load

Different collateral availability

A different risk posture than vault-based systems

If your wallet wants to credibly claim “best yield” or “best borrow,” Compound is part of the minimum set.

Who Actually Uses Compound Inside a Wallet

You are building for three groups:

Stablecoin holders: They want predictable yield. Deposit, earn, withdraw. They do not want to learn protocol nuance.

Borrowers who want conservative credit: They supply ETH or BTC, borrow stablecoins, and care about liquidity and predictable behavior.

Rate shoppers: They compare Aave, Morpho, and Compound and choose based on current rates and available liquidity.

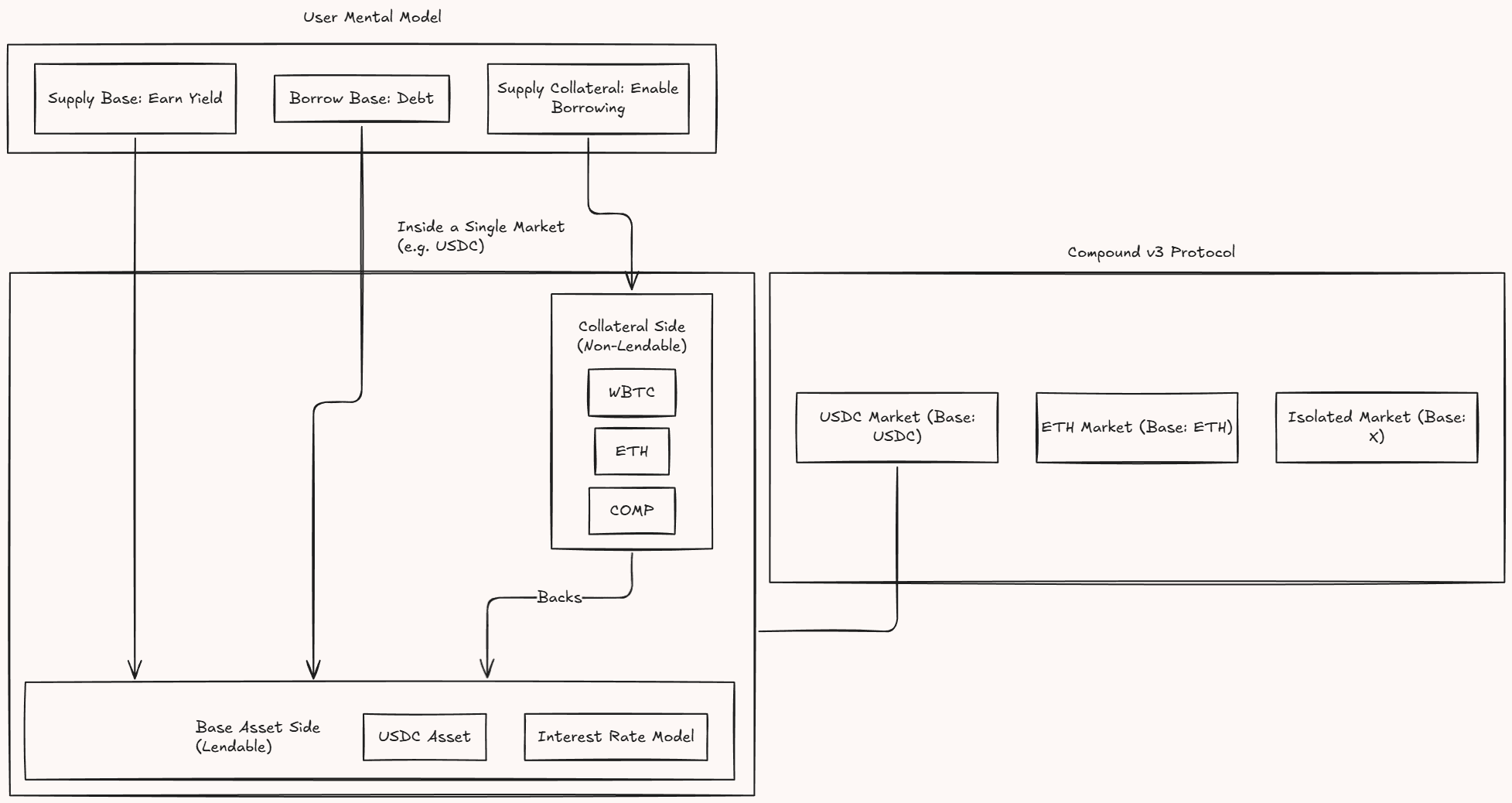

Understanding Compound v3 (Comet) in One Mental Model

Compound is structurally different from both Aave and Morpho, and that changes the wallet UI.

Aave is pool-based and users think in assets.

Morpho Blue is vault-based and users think in vaults and curators.

Compound v3 is market-based, which means each Compound v3 market has:

One base asset (what suppliers earn and what borrowers borrow)

Multiple collateral assets

A single-borrow model per market

So users don’t join “Compound”.

They join “the USDC market” or “the ETH market”.

This changes how you display:

supply vs collateral

borrow availability

liquidation risk

What You Actually Have to Build (Direct Integration Scope)

Compound looks simpler than Morpho Blue because it is not vault-based, but direct integration still becomes an engineering nightmare.

Here’s what wallets end up building.

Multi-chain deployment management: Different chains, different addresses, different market configs. This never ends.

Market discovery and support logic: You need logic for:

which base markets you support

which collateral assets you allow

how you present supply vs collateral clearly

Position accounting: You need correct tracking of:

supplied base balances

collateral balances

borrow balances

interest accrual

liquidation thresholds

Risk monitoring: Users can still get liquidated. Your wallet needs consistent risk math and reliable updates.

Simulation and failure handling: Caps, collateral factors, and market constraints cause reverts. Without pre-checks and clean errors, users will blame the wallet.

The Part Teams Underestimate (And the Faster Way)

The hard part is keeping Compound integration correct as markets shift, chains diverge, and users start rate-shopping.

Because once Compound is live, users ask:

“Where is USDC highest today?”

“Where is borrowing cheapest right now?”

“Why does this chain show different liquidity?”

To answer those questions, you need:

parallel protocol support

unified position display

routing and guardrails across venues

This is where most teams end up maintaining multiple integrations anyway.

1delta replaces that infrastructure layer.

With one integration, you get Compound v3 plus Aave, Morpho, and 200+ lending markets across 50+ chains, with:

supply/withdraw and borrow/repay

market rates (APY and APR)

standardized position data (collateral, debt, liquidation risk)

routing and execution guardrails

ongoing maintenance as markets and deployments change

Typical integration time: 3 to 7 days from API key to production.

Choosing Which Compound Markets to Support

You do not need every market.

A practical rollout:

Start with USDC base markets on major chains

Add ETH markets based on user balances and borrowing demand

Expand based on real usage and liquidity migration

The API gives you flexibility. You define the curation strategy and we execute it.

Let's Ship Compound

Compound is not a “single protocol” integration.

To ship it properly, you’re building multi-chain deployments, market discovery, position accounting, liquidation monitoring, and transaction simulation.

And even after you ship, you need to continuously maintain it.

1delta replaces with a single API.

You integrate once and get Compound v3 plus Aave, Morpho, and 200+ lending markets across 50+ chains, with standardized positions, execution guardrails, and ongoing maintenance.

To explore integration or access, reach out to the 1delta team.

Docs: docs.1delta.io

Contact: Telegram | team@1delta.io