How to Integrate Aave Into Your Crypto Wallet

Learn how to integrate Aave into your crypto wallet, choose the right scope, handle rates, positions, and safety checks, and ship fast.

Written by

Uddalak

How to Integrate Aave Into Your Crypto Wallet

When users try to earn yield inside a wallet, Aave is the first protocol they expect, because it’s the most trusted lending market and is deployed across 18+ chains.

Here’s how to add Aave to your wallet in days, with a clear scope, correct risk handling, and no heavy integrations.

Why Integrate Aave Now

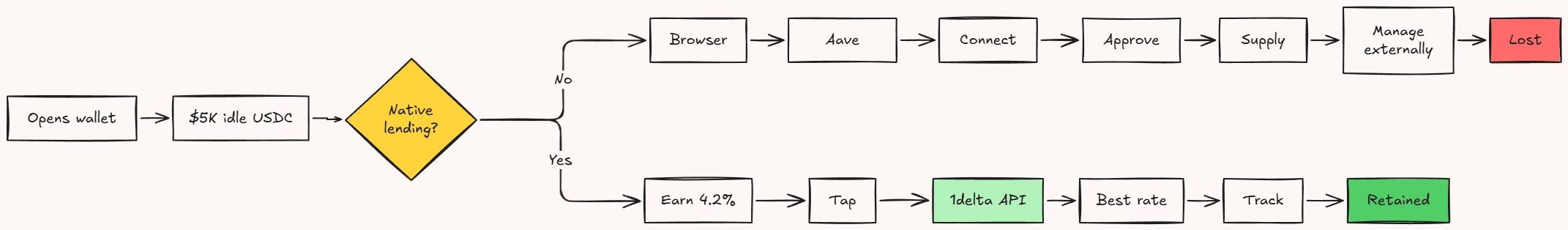

Aave is already where your users lend and borrow. If your wallet doesn’t support it natively, you’re forcing them to leave your product for something they consider basic.

Three reasons this matters:

Your users already use Aave. They use another UI, then come back later. Every step adds churn risk.

Idle stablecoins cost users money. USDC in wallets earns 0%. USDC in Aave can earn 4-8% APY depending on chain and utilization. A user with $10K in stablecoins misses $400-800 per year.

Lending is now a standard wallet feature. If you don’t support lending, you’re missing a core product expectation.

Which Users You’re Actually Building For

Aave inside a wallet is not one product. It’s two.

Product 1: Stablecoin Earn (supply-only)

This is the default wallet feature. It is low-risk, low-support, and high adoption.

Users want:

deposit USDC

see yield

withdraw anytime

Product 2: Borrowing (collateralized loans)

This is a power feature.

It drives volume, but it creates support load and liquidation risk.

Users want:

supply ETH or WBTC

borrow USDC

monitor health factor

repay without surprises

If you’re integrating Aave for the first time, ship supply-only first.

Borrowing can be phase two.

Ship Fast Without Being Wrong

If you’re planning to add Aave to your wallet app, don’t ship too broad and break things or ship too narrow and no one uses it.

A safe starting scope looks like this:

Phase 1 (what most wallets should ship first)

USDC supply only

2 to 3 chains max (Ethereum + Base + Arbitrum is enough)

show supply APY

show withdrawable balance

Phase 2 (when you have real usage)

USDT + other stablecoin supply

add WETH supply (optional)

add basic incentives display (optional)

Phase 3 (borrow)

ETH collateral, USDC borrow

WBTC collateral, USDC borrow

health factor monitoring + liquidation warnings

This keeps your product honest and prevents you from shipping a broken UX.

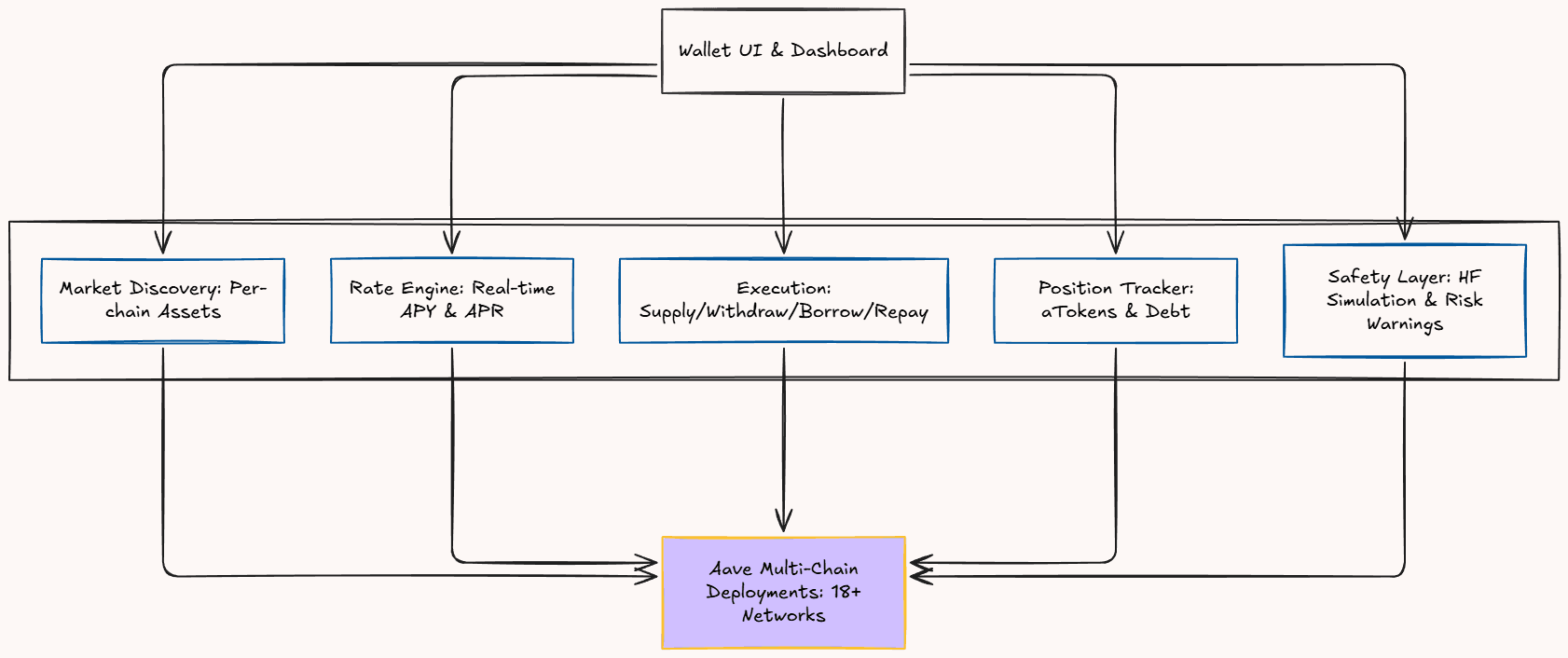

Understanding Aave’s Architecture (What Wallets Need)

Aave looks like 4 actions: Supply, withdraw, borrow, and repay. That’s the easy part.

The hard part is everything a wallet needs around those calls to stay correct, safe, and maintainable across chains.

Aave is multi-chain: Every deployment has a Pool contract, a PoolDataProvider, a PriceOracle, and asset-specific configuration. In each case, caps, collateral rules, and rates differ.

Market discovery (per chain): You need a live view of which assets are listed, which actions are enabled, and what the caps and collateral rules are. If you hardcode them, your wallet will eventually show the wrong markets or let users attempt actions that fail.

Rate math: Supply APY and borrow APR are not static. They move with utilization and are affected by market configuration and reserve factor. Most wallets get this wrong by mixing APR and APY.

Execution edge cases: Users hit approvals, “max” flows that don’t work, withdrawals that revert due to low liquidity, borrows blocked by caps, and repays that behave differently depending on stable vs variable debt.

Position tracking. Aave positions aren’t just “balances”. They are aToken holdings plus debt positions, and they accrue continuously. Your wallet needs to track supplied assets, variable debt, and stable debt to show a correct position.

Health factor and safety checks: If you support borrowing, health factor is your product. That means simulating actions before sending, warning when health factor is near 1, and blocking unsafe borrows and withdrawals.

Integrate Aave Inside Your Wallet (Faster Way)

The entire process can take months because a correct integration requires active developmemt and ongoing monitoring as parameters change.

1delta API replaces that entirely and lets you ship an integration in less than 7 days.

You integrate once, choose your supported chains and assets, and ship Aave with built-in discovery, risk scoring, monitoring, and execution.

Request API access at 1delta.io or view technical documentation at docs.1delta.io.

Contact: Telegram | team@1delta.io