How to Choose the Right Lending Protocol for Your Crypto Wallet (API Guide)

Aave, Morpho, and Compound differ on yield, liquidity, risk models, and market coverage. Learn how wallet teams choose which lending protocols to support, how to filter markets by TVL and utilization, and how to ship multi-protocol lending in 3 to 7 days using the 1delta Lending API.

Written by

Uddalak

If Aave offers 5.2% on USDC, Morpho offers 7.8%, and Compound offers 5.8%, your users ask a simple question: where should I deploy capital?

Protocol choice determines yield, risk exposure, withdrawal reliability, and market coverage.

This guide explains how wallet teams decide which lending protocols to support, how to filter markets, and how to avoid multi-protocol integration overhead by using a unified API.

TLDR

Wallets must balance yield, liquidity depth, risk models, and chain coverage

Aave is baseline for liquidity and breadth

Morpho is rate leader but requires vault-level risk decisions

Compound is the stable middle ground with predictable markets

Supporting 2 protocols at launch is usually enough

Proper market filtering (TVL, utilization, chain context) matters as much as protocol choice

Why Protocol Selection Matters

The choice of protocol affects four decision criteria:

Yield dispersion

Protocols price risk differently. Rates shift by protocol and by chain.

Example: Same stablecoin yields vary because protocol mechanics and liquidity balance differ.

Risk model and liquidation mechanics

Aave settles risk parameters via governance with global risk settings.

Morpho Blue uses vault curators for isolated markets.

Compound uses algorithmic interest rate curves and market-level collateral factors.

Liquidation mechanics (thresholds, health factor behavior) impact withdrawal reliability.

Liquidity depth and utilization behaviour

Aave pools support larger withdrawals with less price slippage.

Morpho vaults may have higher rates but lower liquidity per vault.

Compound markets have steadier utilization curves.

Chain coverage and market availability

Not every protocol supports every asset on every chain.

Multi-chain support determines where yield can actually materialize.

Wallets must understand that yield is not a single number. Yield is a distribution shaped by liquidity depth, utilization, and protocol mechanics.

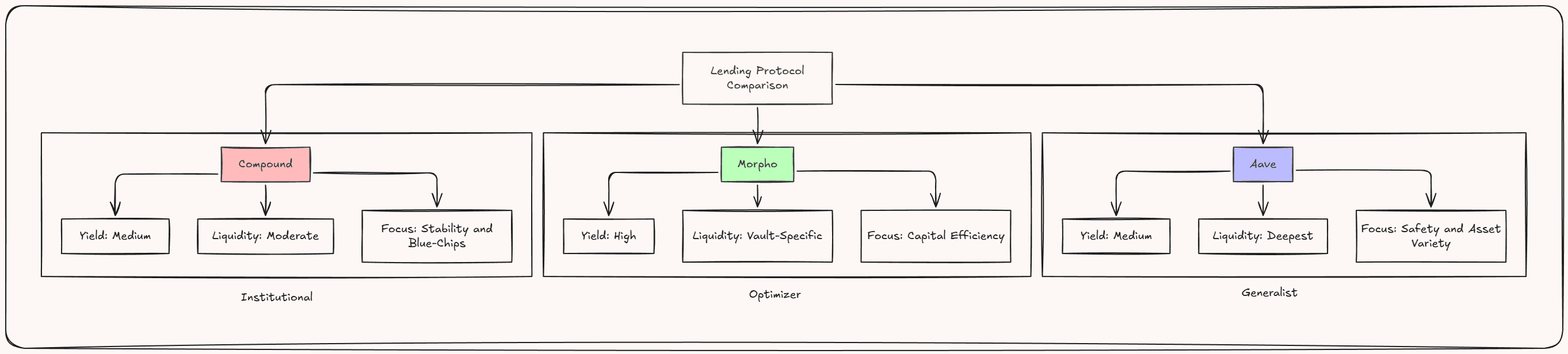

Protocol-by-Protocol Decision Insights

Aave: Liquidity Depth and Breadth

When it wins

Deepest markets across stablecoins and blue chips

Largest multi-chain deployment with conservative risk parameters

Best for large deposits and withdrawal reliability

Strong on assets with high TVL and low volatility

Where it lags

Often lower yields due to pooled liquidity

Average rate can underperform optimized venues (Morpho)

Key signals

High TVL, consistent utilization below 80%, large deposit corridors

User base demands safety and predictable exits

Decision logic

If stability and coverage matter more than rate, support Aave first.

Morpho: Rate Leader, Complexity Trade-Off

When it wins

Peer-to-peer matching pushes lender returns closer to borrower demand

Often highest yields on major assets (stablecoins and ETH)

Structural differences from Aave

Isolated vault markets have risk profiles per vault

Curator reputation and collateral type matter

Yield can diverge rapidly between vaults

Where it lags

Liquidity fragmentation across vaults

More risk decisions at curation layer

Less battle testing historically than Aave

Key signals

Users are rate sensitive

Portfolio sizes where a few percentage points matter ($10K+)

Users familiar with vault mechanisms (DeFi power users)

Decision logic

If yield optimization is key and users tolerate complexity, add Morpho.

Compound: Predictable Middle Ground

When it wins

Algorithmic rate markets with transparent curves

Often sits between Aave and Morpho on yield

Strong governance pedigree and market simplicity

Compound v3 markets (Comet) simplify position accounting

Where it lags

Smaller asset selection than Aave

Liquidity depth usually lower than Aave

Yields often lower than Morpho

Key signals

Users who care about governance participation or predictable rate structure

Markets where Compound’s rate model is competitive

Need for stable middle option in comparisons

Decision logic

If you need a stable protocol with predictable behavior and governance appeal, include Compound.

Decision Framework: Which Protocols and Markets to Support?

Protocols

Wallet teams should avoid overwhelming users and engineering complexity by launching 5+ protocols at once. A crisp, defensible starting point:

Baseline protocol: Aave (liquidity, coverage, trust)

Rate optimization protocol: Morpho (higher yields)

Optional third: Compound (governance and predictability)

You can later add emergent ecosystems like Spark on specific chains, Venus for BNB Chain, Radiant for cross-chain features, or Euler for long-tail assets once core demand stabilizes.

Markets

Let's say, you've picked the protocol. Now, which markets deserve wallet integration?

Asset quality filter: Start with blue chips: USDC, USDT, DAI, ETH, WETH, WBTC

TVL threshold: Markets with >$10M TVL are usually safer

Utilization monitor: Avoid markets above ~85% utilization for new deposits

Yield sustainability check: Unsustainably high APY relative to peer markets often signals incentives or temporary imbalances

Collateral quality and oracle risk: For vault-driven systems (Morpho Blue), curate based on curator reputation and underlying collateral stability

These filters should populate your default product surface. A protocol may be supported, but only certain markets within it make product sense.

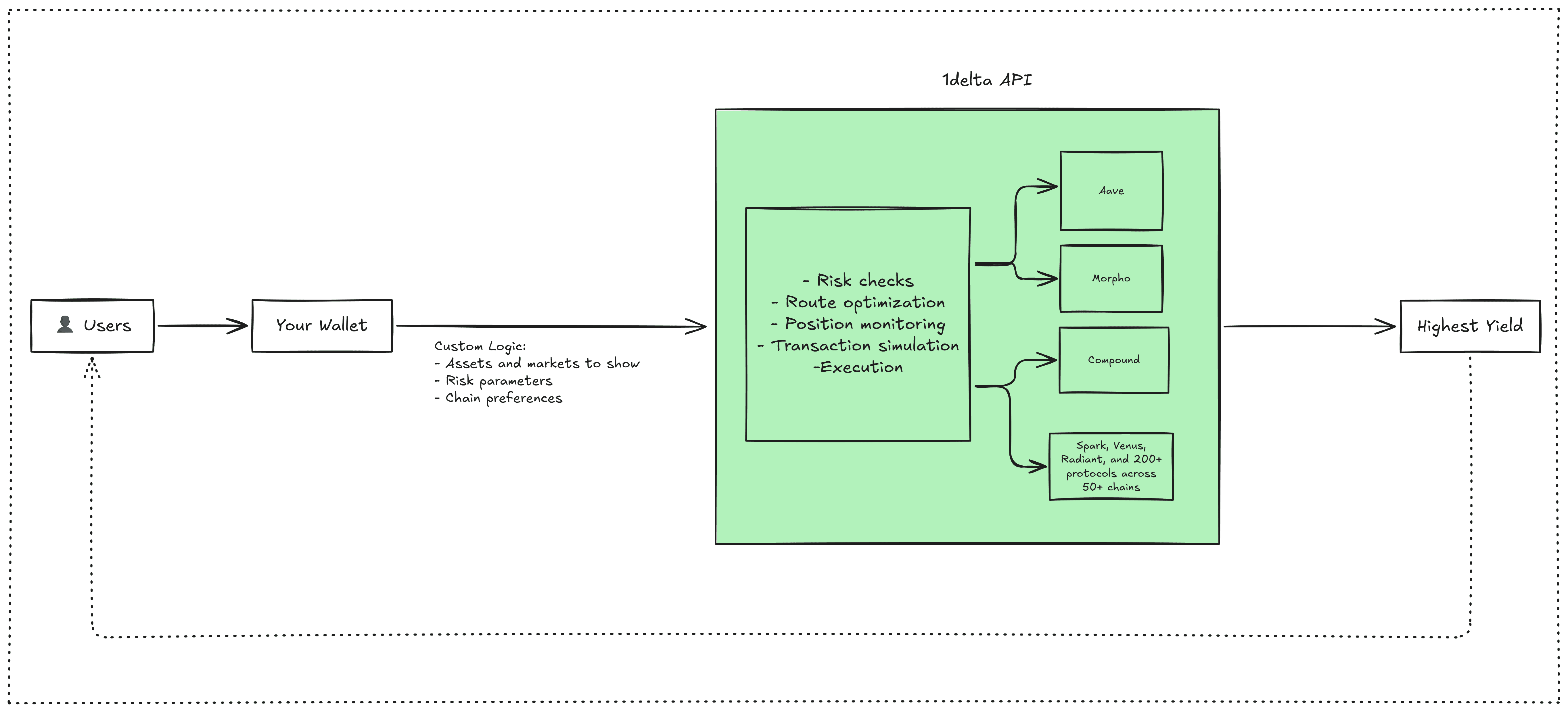

With our unified API, you support as many protocols and markets your users want.

instant multi-protocol support across 200+ protocols

routing logic built in

standardized execution and position tracking

market filtering primitives and risk signals

Integrating 1delta API can unlock depth without multiplying engineering surface area.

Start Shipping

Choose protocols based on what your users actually need:

yield optimizers = Morpho

safety and liquidity depth = Aave

predictable, governance-oriented markets = Compound

Support only a few protocols at launch and expand selectively based on demand signals and usage data.

To explore integration or access, reach out to the 1delta team.

Docs: docs.1delta.io

Contact: Telegram | team@1delta.io