Why DEXs Are Adding Earn on Idle Deposits (And How to Do It)

Binance pays users 3.56% APY while they wait to trade. Coinbase integrated Morpho to offer 3.35% on idle USDC. DEXs are starting to follow, here's why it works and how to ship it fast.

Written by

Uddalak

Uniswap holds $3.07B in TVL. Hyperliquid has $1.5B. Not all of that capital is actively trading and some sits between positions, waiting for opportunities, or held as reserves.

That idle capital could earn yield, and users know this. They're probably moving funds to Morpho or Aave when not actively trading, then withdraw back when they want to trade.

But what if users never had to leave? What if deposits earned yield automatically while sitting on your DEX, and trading still worked instantly?

Binance Earn products pay 3.56% APY on flexible deposits. Coinbase pays up to 3.35% APY on USDC through Morpho integration with one tap deposit and withdrawals.

DEXs can do the same. The infrastructure exists now.

Why DEXs Need to Add Earn Features?

1. TVL retention

Users keep full trading capital on your platform instead of splitting balances. If a user wants $100K available for trading but your DEX pays 0% on idle deposits, they might keep $20K on your DEX and $80K on Morpho or Aave.

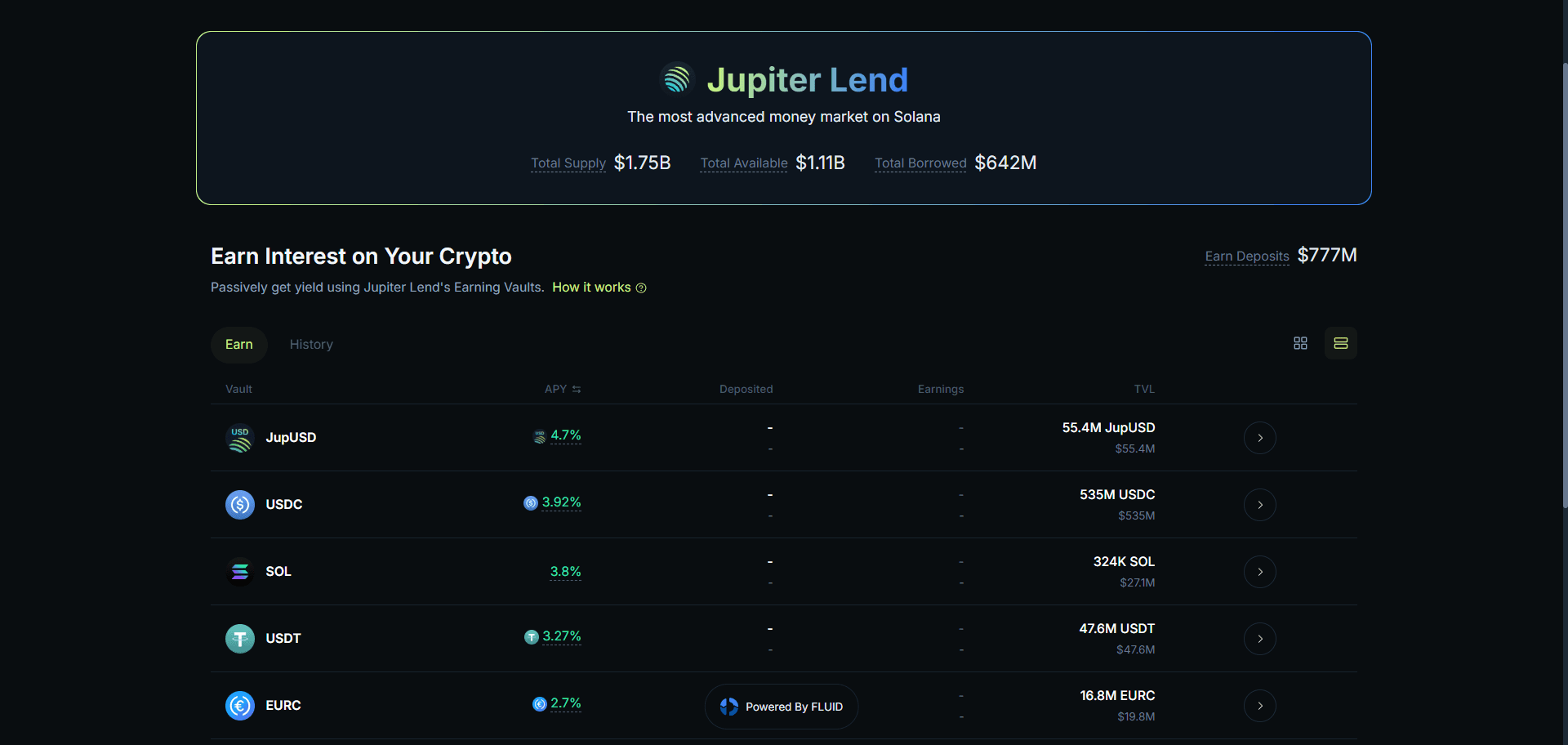

Jupiter Lend, powered by Fluid, currently has $1.75B in TVL, validating DEX + lending demand on Solana.

2. New revenue stream

Take a cut out of yield earned by users as protocol revenue.

Example: $500M in deposits, 40% idle at any time = $200M earning 5% APY = $10M annual yield. Protocol takes 10% = $1M new revenue stream.

3. Competitive positioning

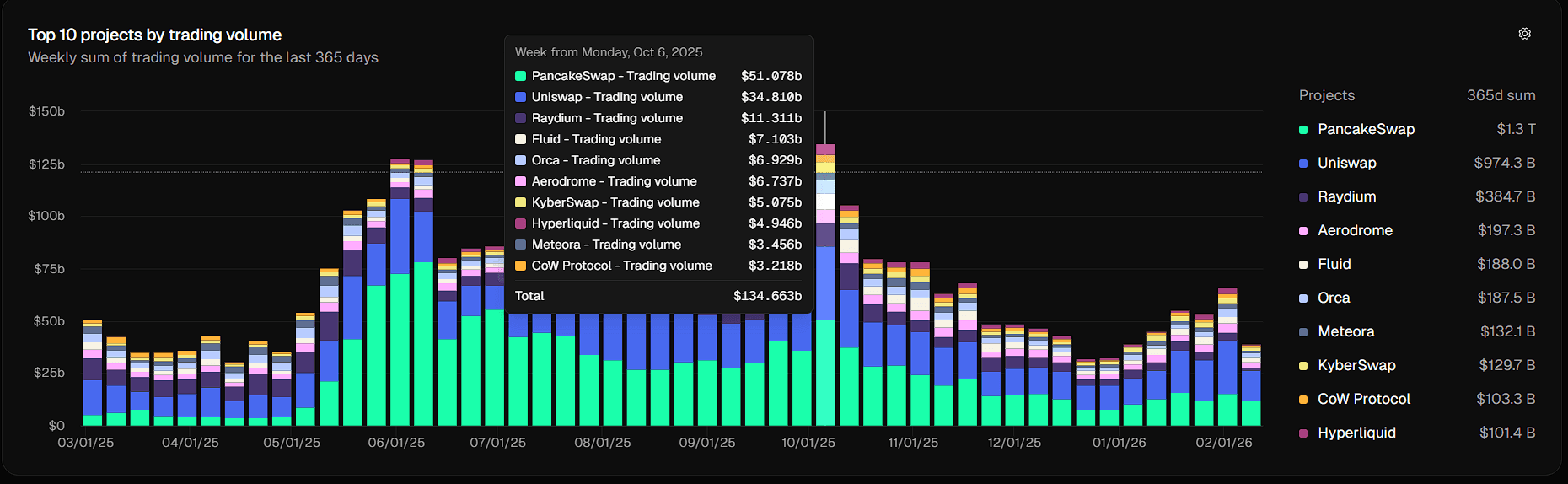

DEX market share shifted dramatically in 2025. PancakeSwap became the top DEX and the overall Spot DEX volume peaked at $134.66B on October 6. Although the overall number is down now due to market conditions, it shows the broader trend.

TLDR: Features that make capital work harder win deposits. "Trade on [Your DEX] and earn 5% on idle capital" is a clear differentiator when users compare platforms.

How It Works (User Experience)

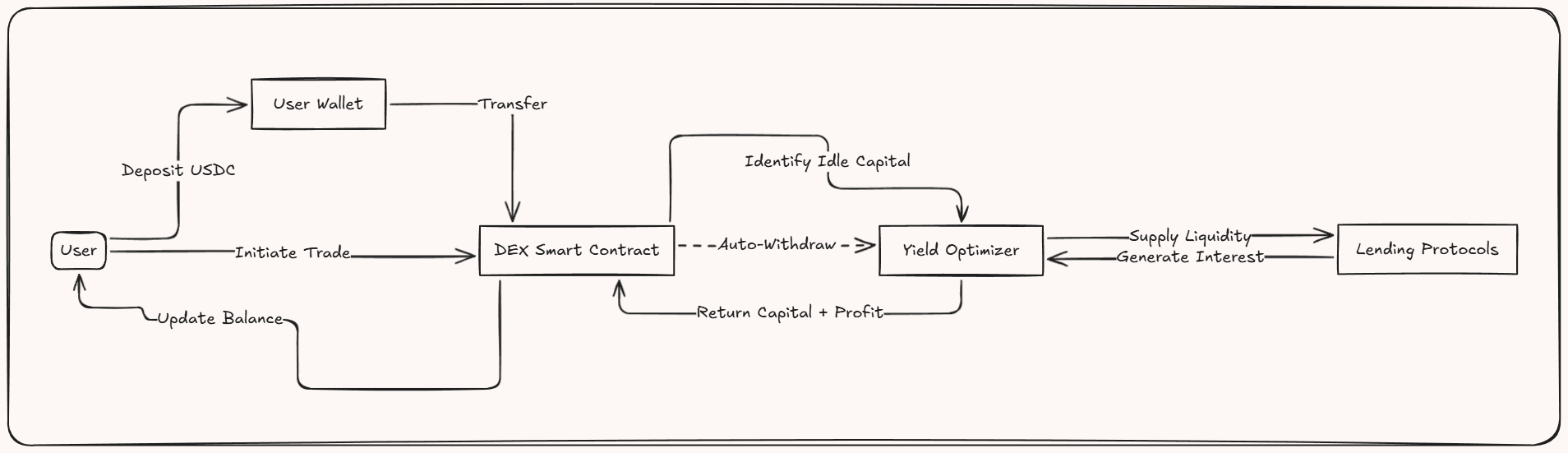

User deposits $10K USDC to your DEX. Capital sits idle with no active trades or pending orders. Your platform automatically supplies idle USDC to Aave or Morpho. User earns 3-8% APY depending on current market rates.

When user wants to trade, your platform withdraws from lending instantly, executes trade. Remaining capital returns to lending automatically.

User sees: "Idle balance: $10,000 USDC earning 4.7% APY" in dashboard. Trading works exactly the same way. No extra steps, no extra clicks.

Platform manages: Idle detection, automatic best-rate selection, instant withdrawal on trade, yield distribution.

User gets capital efficiency without complexity. Platform gets TVL retention and new revenue.

Implementation: The Direct Integration Path

You could integrate Aave or Morpho directly. This works, but creates ongoing maintenance:

Rate selection: Aave rates range 2-14% APY depending on utilization. Morpho offers 8-15% through peer-to-peer matching. Compound has different rates on different chains. Which protocol has the best rate right now? Rates change hourly.

Multi-chain deployment: If you operate on Ethereum, Base, Arbitrum, Optimism, Polygon, etc. - each chain needs separate integrations.

Protocol upgrades: When lending protocols upgrade contracts or change rate models, integrations need updates. If Morpho launches a new vault or Aave changes its rate curve, your code needs changes.

Position tracking: User deposits $10K on Ethereum, $5K on Base, $3K on Arbitrum. Each supplied to different protocols. You need unified tracking showing total yield across chains and protocols.

Direct integration is doable. It takes months to build and ongoing engineering to maintain. For some teams, this is the right path, especially if you want full control over lending logic.

Use an Aggregation API Like 1delta

If you want to ship faster without ongoing lending maintenance, use an API that handles protocol selection and routing.

How 1delta works: Your DEX calls API when capital is idle. API queries rates across 230+ protocol integrations and 30+ chains, selects best rate, returns transaction. Your DEX executes.

When user trades: Call withdraw API, get transaction, execute. Trade proceeds instantly.

What this provides:

Automatic best-rate selection across protocols

Multi-chain support with same API pattern

Unified position tracking (one call shows all yields)

Protocol upgrade protection (your integration doesn't break when protocols change)

Gas optimization through batching

For teams that want to ship this feature fast and focus engineering on core trading infrastructure, the API route makes sense.

Revenue Model

Adding earn on deposits creates revenue without changing your core trading business:

Take rate on yield: Charge a cut out of the yield earned by users. User earns $100 in lending APY, protocol takes a fee.

Increased trading volume: Users keep more capital on your platform, leading to more trades and more trading fees.

Premium tiers: Offer standard yield (automatic routing to good rates) for free. Offer optimized yield strategies (higher APY through advanced routing) as premium feature.

This doesn't cannibalize trading fees. It creates a new revenue stream from capital that was previously earning 0%.

Integrate Lending Yields Inside Your DEX

The feature is proven. Users want capital efficiency. Together, it's a win-win situation for a platforms that offer it.

1delta provides the API for DEXs that want to ship fast and access to 200+ protocol integrations across 50+ chains with automatic rate optimization, multi-chain position tracking, and protocol upgrade protection.

Request API access: 1delta.io | Documentation: docs.1delta.io

Contact: Telegram | team@1delta.io