1delta: A Decentralized Brokerage Protocol

Explore the intricacies of leveraging the vast liquidity available in major lending protocols, and the challenges faced with over-collateralized loans. Delve into how 1delta's innovative solution seamlessly merges lending pool swaps via flash loans in a single transaction. Learn about the unparalleled benefits of 1delta, such as its unified interface, deep DeFi liquidity access, and the ability to retain asset custody, as it builds upon platforms like Aave, Compound, Uniswap, and Polygon.

Written by

Billions of dollars in liquidity can be found the major lending protocols which feature the lowest borrow rates in the market. Accessing their liquidity for trading purposes is not a simple task. A user has to deposit funds which allows them to borrow from the protocol. Today's lending protocols however are over-collateralized, meaning that a user can only borrow less than the amount they deposited in a single transaction.

For example, a user depositing $1,000 in USDT means that they only can borrow $700 in WBTC (corresponding to a collateral factor of 70%). The user can extend the position by swapping the borrowed WBTC to USDT and re-supply the received $700 worth of USDT. That gives an additional 70% x $700 = $490 borrowing capacity. The total percentage of borrowable funds based on the original deposit is now 70%+70%²= 119%. The user now can borrow again, swap and re-supply until they get their desired position size or leverage.

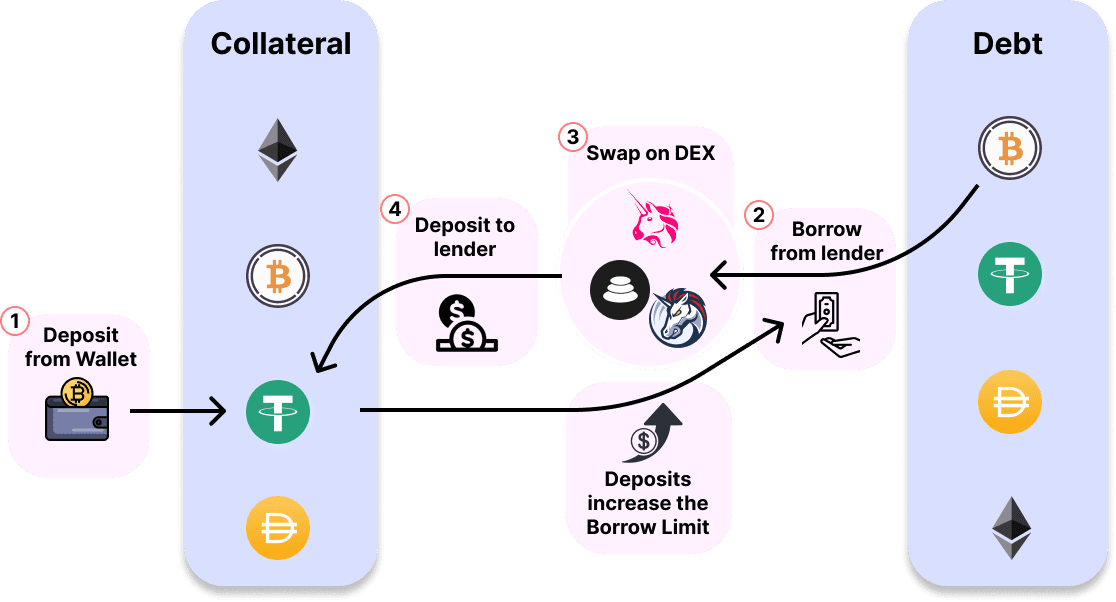

The following chart shows the process flow:

1) A first USDT deposit is required for taking out a loan; 2) we can borrow WBTC to our wallet; 3) we swap WBTC to USDT on a DEX; 4) we deposit USDT to the lender; we repeat from step 2) until we reach the desired position size.

This poses a number of challenges

Transactions span multiple dApps like (Uniswap and Aave)

With numerous manual steps, errors are likely

Users often miss ideal entry points after initial borrow transaction

The 1delta protocol solves these issues while still giving full control to the user. This means that a user should still be able to enter the same configuration for their trades that a conventional DEX interface would allow.

1delta Abstract Accounts Are Able to Compose Margin Trades in a Single Transaction

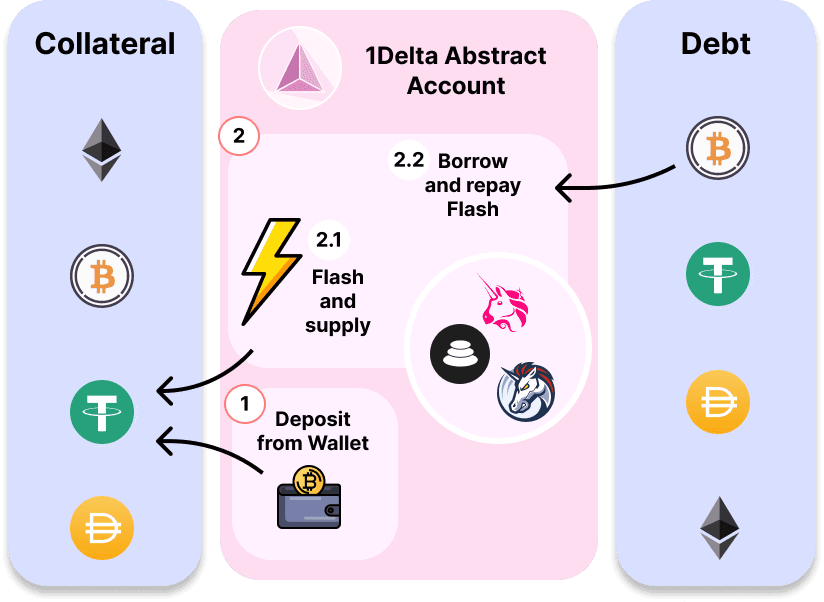

1delta Accounts are user-directed smart contracts, streamlining lending pool swaps via flash loans/swaps in one transaction – a feat often unattainable on similar lending protocols like Compound.

Illustration of an abstract account that opens a position (borrow and supply) with flash swaps or flash loans in only two steps. As the 1delta account is a smart contract, these steps can also be batch-executed in a single transaction.

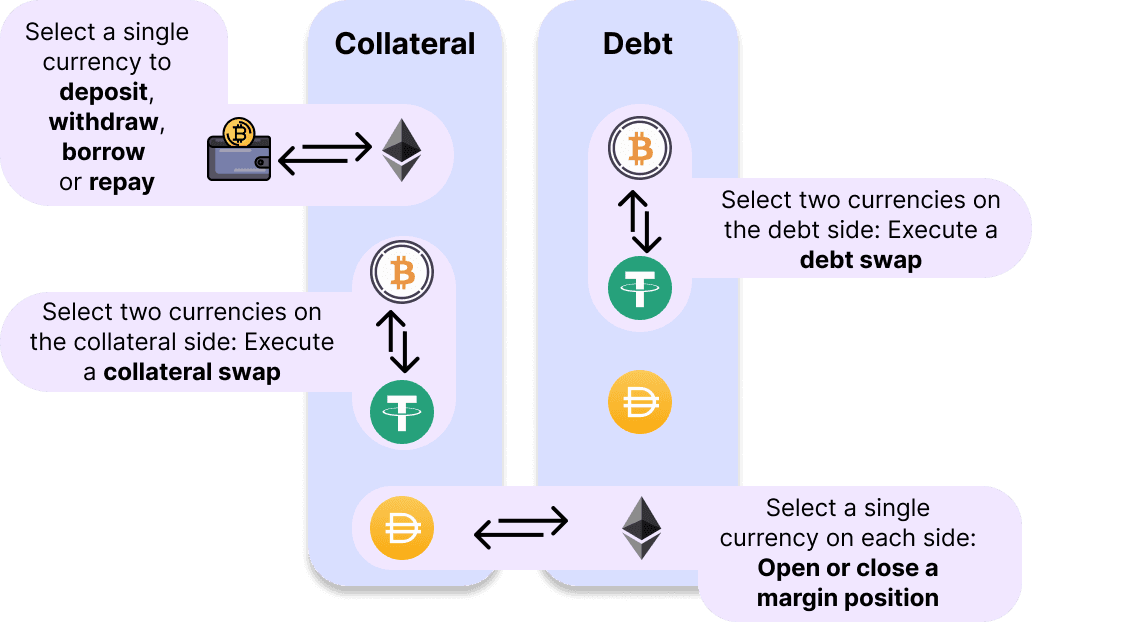

When you click on start trading you can start building a position. Other than trading on margin, our interface allows you to execute a few common and useful trade types to make 1delta your complete destination for trading crypto.

Your selection in the market tables leads to different trade settings. When a single currency is selected, the interaction is similar to a conventional lending protocol, except that the user also has the option to add DEX interactions e.g. to add a swap before the deposit in the same transaction.

Building a Margin Position with 1delta

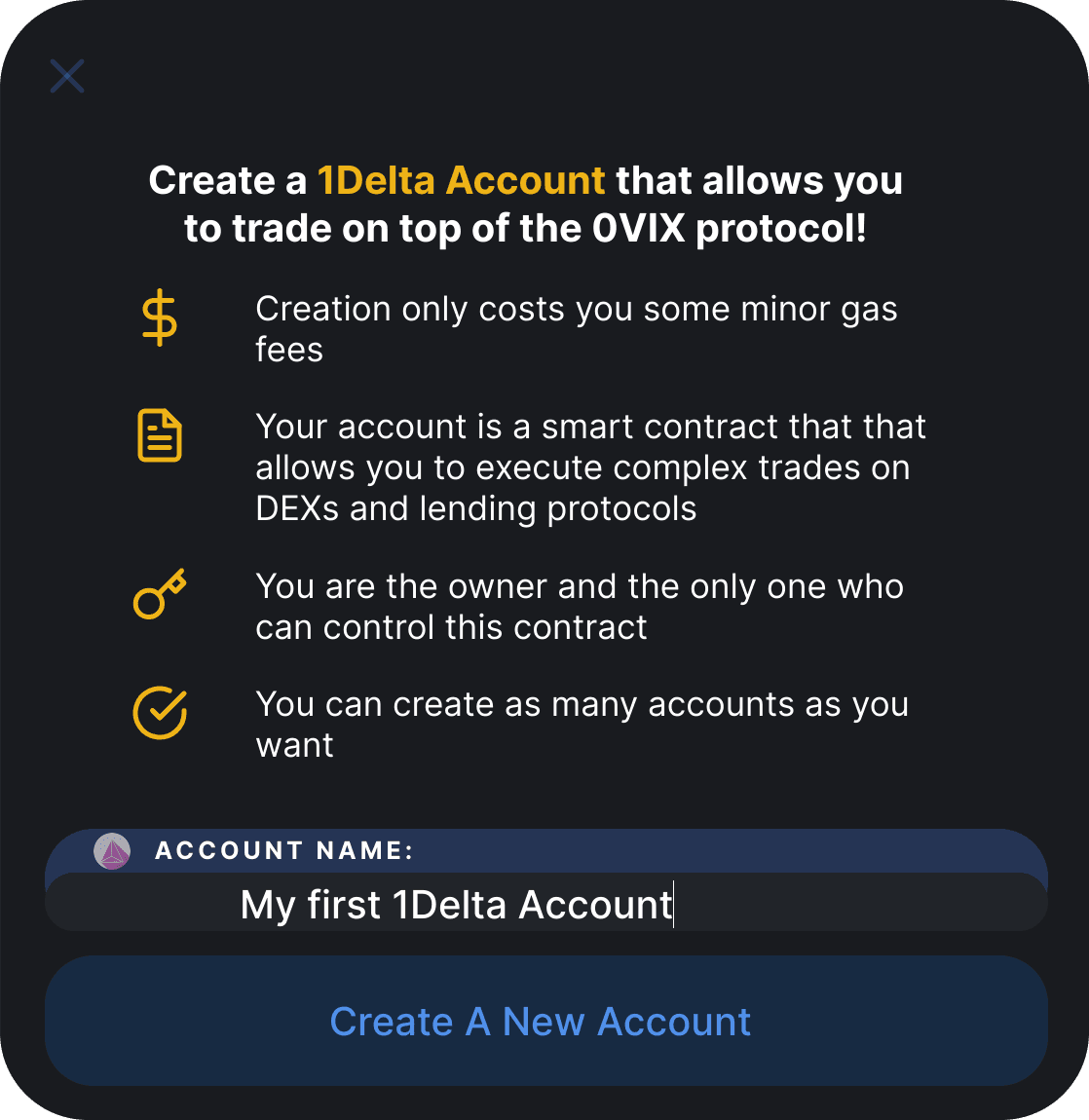

To begin trading, you will need to create a 1delta account. The account provides you with flexibility, control and is very cheap to create — only minor gas fees are incurred.

The account creation is just a single contract call and deploys your own 1Delta account to the EVM.

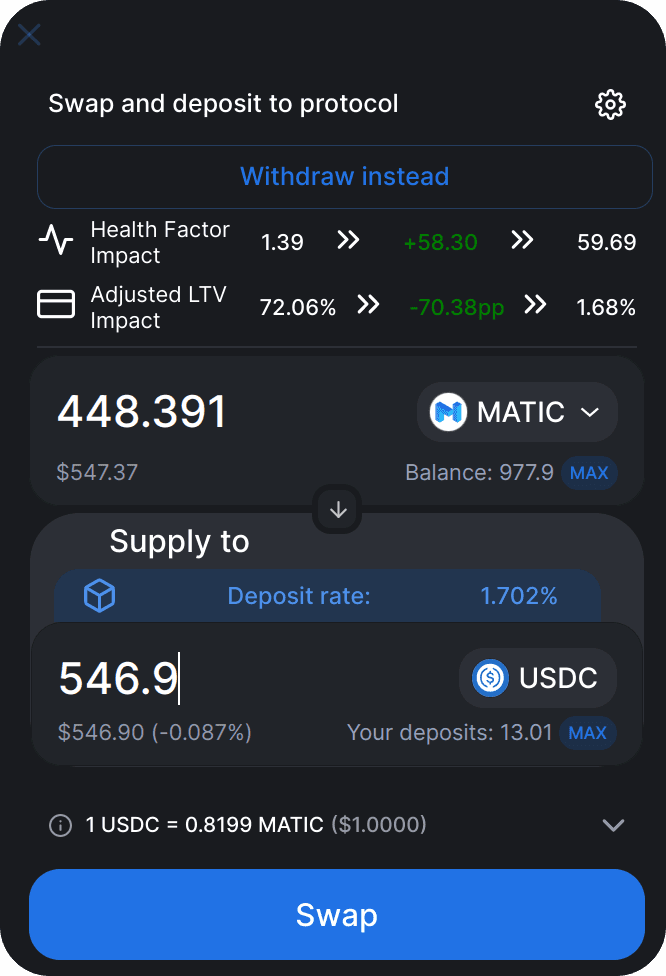

Once the account is created, you can deposit funds to the lending protocol. If you do not currently own the token you want to deposit, you can also swap and then supply in the same transaction using a Uniswap-style interface:

A swap and supply transaction — A complete DEX UI combined with LTV and health factor indicators as is common for lending protocols like Compound or AAVE.

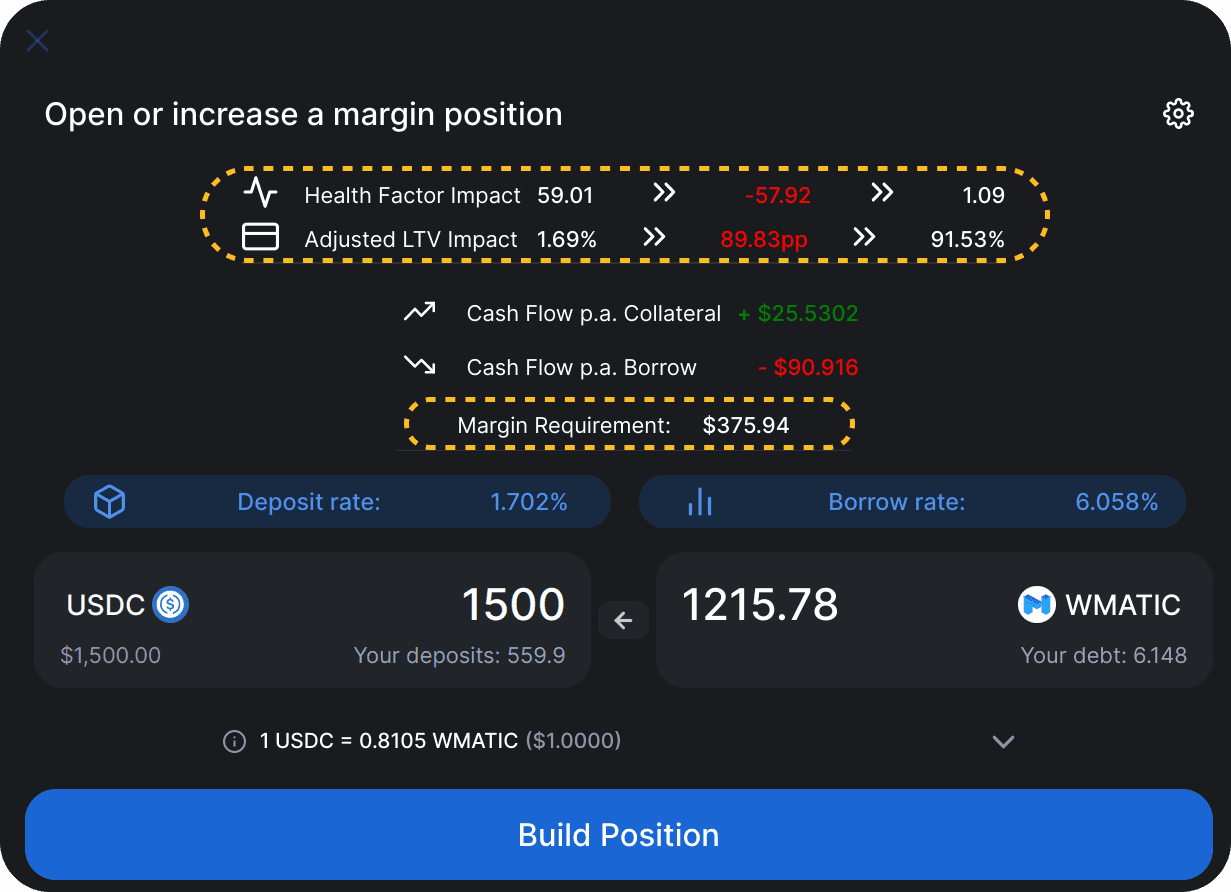

It is now time to trade on margin. With your deposited collateral you can now use the full capacity of your borrowing power. Even though the direct borrowing capacity of the ~$560 we deposited would limit us to borrowing less than this amount, we can borrow and supply an equivalent of $1,500 in a single transaction:

Opening a margin position was never easier — The margin requirement states how much collateral you have to supply to make the transaction work. With our deposit of ~$560 in USDC we have enough, however, the health factor drops below 1.1 on execution.

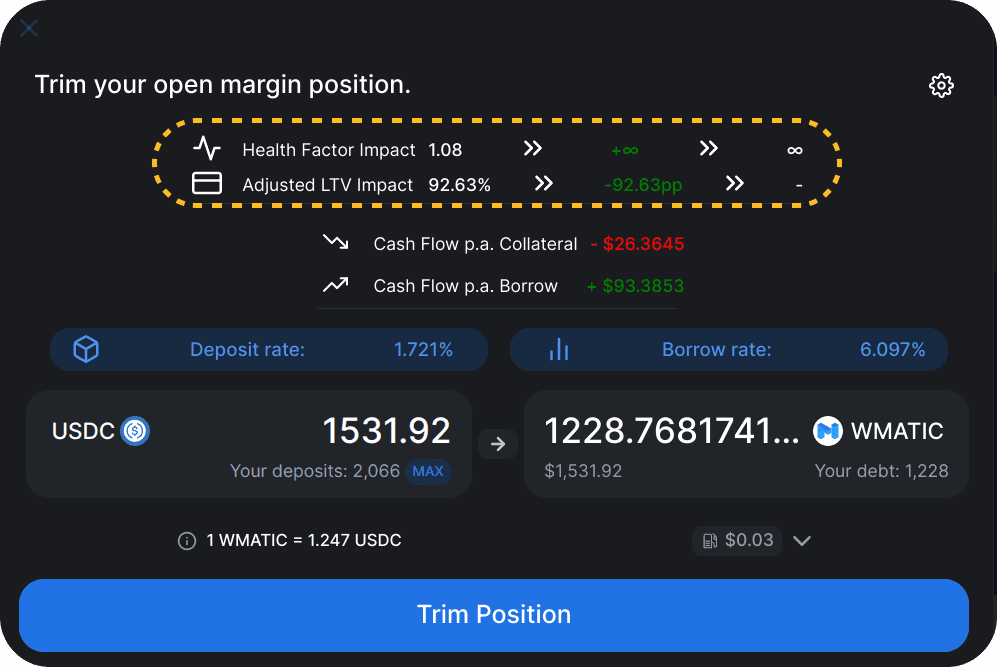

If our health factor gets very low, the manual withdraw-swap-repay cycle would lead to a significant hassle when trying to unwind the position, all while 1delta executes the interactions in a single transaction:

Our health factor is immediately restored if we trim the full position by selecting the maximum output amount on the right hand side. The dApp will also make sure that there is no dust left.

1delta introduces a new era of DeFi aggregation

The 1delta protocol allows you to:

get access the deep liquidity of DeFi

get access to the best rates in DeFi

keep custody of your assets

compose swaps and lending interactions in a unified interface

be eligible to receive all of the lending protocols’ benefits, like:

– (pre-)mined rewards

– additional rewards paid by stakers (like Lido)

Check out our app — Proudly building on top of 0VIX and Uniswap on Polygon, with many more collaborations in the pipeline!

The whitepaper is available on our landing page

Stay up to date with us on Twitter