Why Wallets Need Lending Integration (And How to Ship It in 2 Weeks)

If the wallet is where assets live, it should also be where core financial actions happen.

Written by

Uddalak

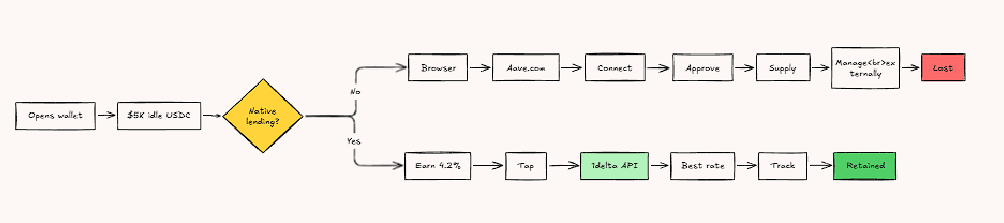

Most crypto wallets today do three things well. They store assets, enable transfers, and route users to swaps or external dApps.

This model worked when wallets were primarily key managers. It is no longer sufficient in 2026. Users expect idle assets to earn. They want access to liquidity without selling long-term holdings.

This blog explains how and why a wallet needs to bring lending access to their users.

What Lending Access Inside a Wallet Means

Lending access inside a wallet allows users to perform core lending actions without leaving the wallet interface or App.

It typically includes:

Supplying assets to onchain money markets to earn yield

Borrowing liquidity against deposited collateral

Viewing active positions, interest rates, and risk metrics natively

Lending actions are executed in-app, with complexity handled by a lending API layer behind the scenes.

Why Embedded Lending Makes Sense for Wallets

Lending access inside a wallet changes how the wallet fits into a user’s financial workflow.

User experience

Assets already live in the wallet

Earning or borrowing should not require leaving it

Fewer steps lead to higher execution, especially outside DeFi-native users

Engagement

Transfers and swaps are one-off actions

Lending positions persist over time

Users return to monitor yield, utilization, and risk

Business alignment

Revenue tied to capital usage

Monetization beyond transfers and swaps

Incentives aligned with improving financial outcomes

Leading wallets have started surfacing yield and DeFi actions natively, signaling a move toward wallets as financial frontends.

Why APIs Are the Only Scalable Way to Embed Lending

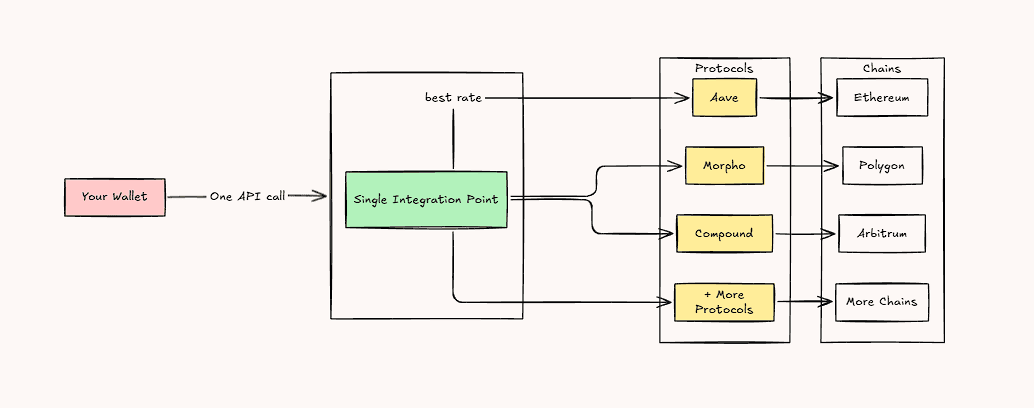

Lending spans multiple protocols, chains, and rate models. For wallets, integrating each market directly does not scale.

An API layer abstracts this complexity.

It unifies lending access, standardizes actions like lending and borrowing, and allows wallets to focus on product and user experience rather than protocol logic.

And this is where 1delta API fits in:

Aggregated access to major onchain lending markets

Designed to sit natively inside wallets

Abstractions built for wallet interfaces and Apps

The result is simple. Wallets offer lending as a native financial action, while protocol complexity stays behind the API layer.

This allows wallets to offer lending as a core financial action without fragmenting the user experience or the underlying infrastructure.

Integrate Lending Into Your Wallet

Storage, transfers, and swaps are table stakes. Most wallets already offer them, and users rarely choose a wallet based on these features alone.

What differentiates wallets going forward is whether assets can do more without leaving the app. Lending access turns a wallet from a utility into a financial surface where capital is actively used.

If you are evaluating how to offer lending natively, the 1delta API provides a clear path to embed lending access directly inside your wallet.